The Eighth Annual AI Startup Landscape

935 German AI Startups working across enterprise functions, AI Capabilities, technology type and industries.

The appliedAI Institute for Europe publishes the German AI Startup Landscape annually – the most comprehensive and influential analysis of Germany’s AI startup ecosystem. Its purpose is to strengthen technological sovereignty, accelerate AI adoption, and foster partnerships between startups and established corporations. Over the years, the German AI Startup Landscape has become Germany’s most trusted strategic reference for policymakers, corporates, investors, and researchers seeking to navigate and engage with the country’s dynamic AI innovation network.

In collaboration with partners from academia, government, and industry, we are committed to building an ecosystem in which AI startups can thrive and contribute to shaping the future of AI for the benefit of society. By establishing a centralised database of high-quality, externally validated AI startups, we enable corporations, SMEs, and public institutions to identify and connect with trustworthy AI partners. For the third consecutive year, we are also proud to present the most promising AI startups in Germany, selected through a vote among our highly regarded contributors.

Together with Deutsche Telekom, NVIDIA, Hitachi, UnternehmerTUM, and eleven leading venture capital firms (Cherry Ventures, Earlybird Capital, UVC Partners, Yttrium, High-Tech Gründerfonds (HTGF), eCAPITAL, Burda Principal Investments, HV Capital, Bayern Kapital, BMH, and the AI.FUND), more than 1,000 startups were assessed. Eligible startups were founded in or after 2015, with a primary business model based on AI (cf. methodology below). All selected startups are headquartered in Germany.

Applications are now open for the AI Startup Landscape 2026. Outstanding AI startups wishing to be considered for inclusion in next year’s edition are warmly invited to apply here!

How to use the Landscape

Below, you can view all 935 startups, organised by their primary category within the clusters of Industry, Technology Type, AI Capabilities, or Enterprise Function.

You may also search for startups by name or by keywords contained in their description. Hover over the logo and select the magnifying glass to read the full company description, or click directly on the logo to visit the startup’s website and learn more.

Beneath the map, you will find a table listing all startups with further details, including secondary categories. At the bottom of the page, you can explore insights into the data as well as key learnings from the German AI startup ecosystem.

Download the high-resolution version of the landscape here:

Methodology

Following academic standards, we developed a robust, strict and objective methodology for screening, analysing and evaluating all AI start-ups in Germany. Overall, the process can be summarised as follows:

Throughout the year, start-ups may apply to be featured in the Landscape via our online survey. In addition, we conducted a comprehensive screening of the German start-up ecosystem and accepted nominations from our contributors (Deutsche Telekom, NVIDIA, Hitachi, UnternehmerTUM, Cherry Ventures, Earlybird Capital, UVC Partners, Yttrium, HTGF, eCAPITAL, Burda Principal Investments, HV Capital, Bayern Kapital, BMH and the AI.FUND).

Start-ups are then evaluated based on data, talent, AI methods, scalability and overall quality and subsequently clustered (see “clustering logic” below). The start-ups are initially rated (‘shortlisted’ or ‘discarded’) by our AI Expert Team to create a shortlist. To enhance the validity of our results, all start-ups are evaluated by several experts. Unclear cases - i.e., start-up evaluations where the experts disagreed - were then individually evaluated in a larger expert group, resulting in a final “shortlist” or “discard” decision.

Start-ups featured in the previous year’s AI Startup Landscape are automatically carried forward into the new edition, unless they have ceased operations, been acquired, pivoted their business model away from AI or relocated outside Germany. In addition, any start-up included in the previous year’s edition that has exceeded the age threshold of ten years is removed.

In order for a start-up to be approved for the AI Startup Landscape, they must meet the following requirements:

- Be a registered company.

- Have been founded less than 10 years ago or pivoted their core business model to AI less than 10 years ago (including 2015).

- The startup’s headquarter must be situated in Germany.

- They should have a minimum of two Full Time Equivalents (FTEs).

- They should have a minimum of one FTE with AI competence.

- They should have AI at their core or exhibit a significant usage of AI.

- The start-up respectively its business model has a high face validity (e.g., professional website, convincing business model, etc.).

The shortlist is independently evaluated and rated by our jury (Deutsche Telekom, NVIDIA, Hitachi, UnternehmerTUM, Cherry Ventures, Earlybird Capital, UVC Partners, Yttrium, HTGF, eCAPITAL, Burda Principal Investments, HV Capital, Bayern Kapital, BMH, and the AI.FUND)).

In a final step, all feedback received is then synthesised and analysed by the experts of the appliedAI Institute for Europe.

Clustering logic

The clustering logic is based on Shivon Zilis’ landscape of machine intelligence. It is developed from the point-of-view of companies that want to use AI in their businesses:

Enterprise Functions: Increasing productivity of existing tasks. Support your employees with ready-to-use, AI-enabled tools supporting their day-to-day work to increase productivity.

AI Capabilities: Exploiting new data sources. Tap into new insights that were previously too difficult or expensive to be gained through conventional methods.

Technology Type: Building products with ML. Give developers the tools that they need to build and leverage machine learning software to gain a competitive advantage.

Industries: Leveraging AI-first products: Use and cooperate with startups using machine learning to offer industry-related products and services.

Deeper Insights about the German AI Startups

Landscape Growth:

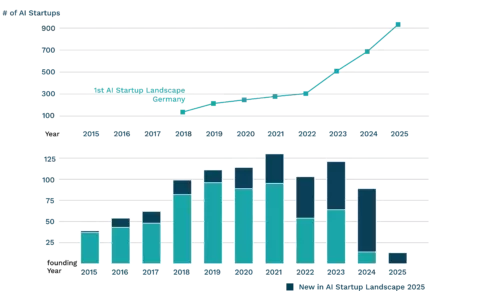

Following last year’s trend, we again see a massive surge in the number of AI start-ups in Germany. There are 935 start-ups on the German AI Startup Landscape 2025 representing a 36% growth compared with the previous year. This growth is almost similar to last year’s growth rate (35%) and underscores the continuing momentum and dynamics of the German AI start-up scene.

From 687 AI start-ups in the 2024 AI Startup Landscape, 622 remain on the list and 313 new AI start-ups were added to the list. Thus, the survival rate of AI start-ups is extremely high (> 90%) compared with the survival rate of non-AI start-ups. Out of 65 AI start-ups that are not represented on the German AI Startup Landscape 2025 anymore, approximately two-thirds (65%) filed for bankruptcy. 19% had to be removed as they were now older than 10 years. The remaining start-ups either exited (11%) or moved their headquarters outside Germany (5%).

Overall, three things are worth mentioning regarding this year’s AI Startup Landscape from our perspective: First, similar to last year, it needs to be noted that there is a discrepancy between the actual founding of an AI start-up and being featured on the AI Startup Landscape. The reason for this is that only AI start-ups are listed that display a strong business model with a certain number of FTEs and internal AI competence (cf. subsection “Methodology” for further information). As such, there is a time lag between the initial founding of an AI start-up and being featured in our list, as only high-quality AI start-ups are listed (and, in turn, AI start-ups with limited resources and unspecified value propositions are not yet listed as they are still in the process of further development). Given the fact that more and more start-ups try to position themselves as “AI companies” despite not actually having any internal AI competence, following our rigorous procedure seems more important than ever.

Secondly, it appears noteworthy that Germany’s AI start-up ecosystem has experienced another year of substantial expansion, reinforcing its position as a key driver of innovation within the country’s digital economy. The number of active AI start-ups has reached 935, representing a year-on-year increase of 36%. This sustained growth—closely aligned with last year’s rate—signals not only the resilience but also the accelerating maturity of the domestic AI innovation environment. The consistent upward trend reflects a combination of factors: increased investor confidence in AI-driven business models, growing demand for AI solutions across sectors, as well as the deepening integration of AI technologies, especially into industrial processes.

Furthermore, from a purely quantified point of view, the steady pace of new market entrants underscores the effectiveness of Germany’s expanding support structures, including incubators, accelerators, and public funding programmes, in fostering the emergence of competitive AI ventures.

However, despite the significant growth in the number of AI start-ups, scaling remains a major challenge, as many German AI ventures struggle to secure especially late-stage funding. Additionally, limited access to international markets, along with the slow adoption of AI by both German companies and government institutions, continues to hinder the transition from rather small start-ups to internationally competitive large tech players.

Third, since the EU AI Act entered into force on 1 August 2025, it is important to note that, from an empirical standpoint, no negative consequences for AI start-up founding activities in Germany can be observed. While it remains conceivable that regulatory frameworks may influence founders’ decisions on the location of their headquarters, the current evidence does not support any definitive conclusions—whether positive, negative, or neutral—regarding the EU AI Act’s impact. Establishing causality would require comprehensive longitudinal data and analysis. Current market dynamics appear largely unaffected by this specific legislation.

Location:

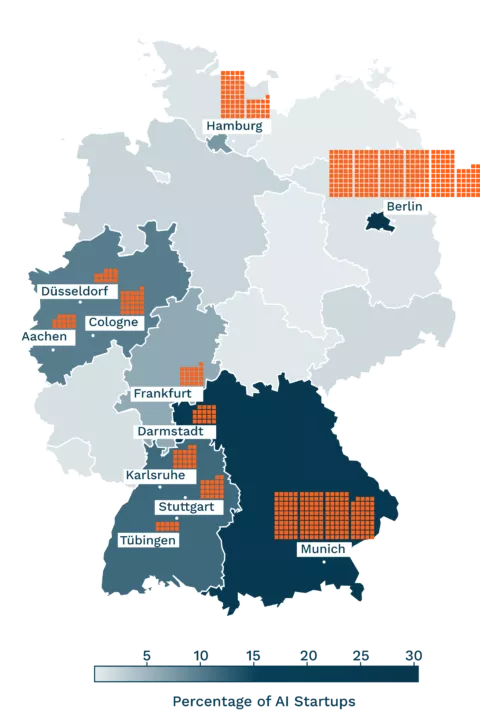

As in previous editions, Berlin and Munich continue to dominate the German AI Startup Landscape, together accounting for nearly 50% of all AI start-ups in the country. Berlin once again leads as the German city with the highest number of AI start-ups, hosting 283 companies, while Munich follows in second place with 200 start-ups, including those in its surrounding suburbs. However, several other cities are rapidly closing the gap, demonstrating significant growth. Notably, the following cities each boast double-digit numbers of AI start-ups: Hamburg (71), Cologne (26), Karlsruhe (22), Stuttgart (22), Frankfurt (21), Darmstadt (19), Aachen (14), Düsseldorf (13), and Tübingen (10). This diversification signals a maturing ecosystem where innovation is spreading beyond the ‘traditional’ start-up hubs.

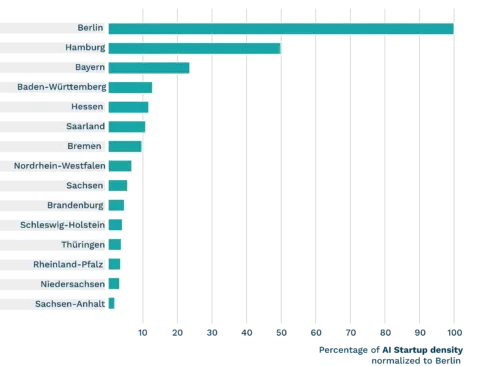

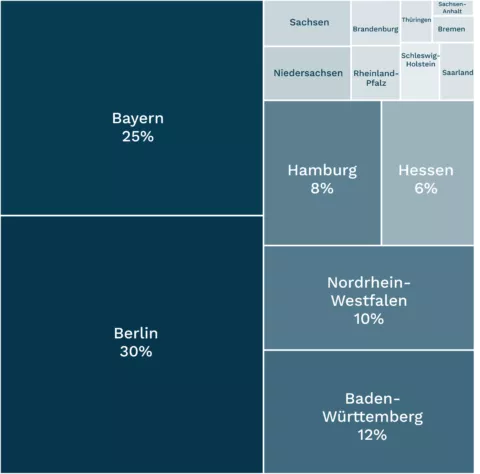

At the federal state level, Berlin (30,3%) again dominates the AI landscape in Germany, followed by Bavaria (25,2%), Baden-Württemberg (11,7%), North Rhine-Westphalia (9,8%), Hamburg (7,6%) and Hesse (6%). Put differently, six federal states account for an astonishing >90% of the German AI start-ups.

To establish a more meaningful interpretation of the results, the AI start-ups per capita of a federal state should be considered. This leads to an interesting shift in the ranking. The data shows the number of inhabitants per AI start-up across German states, revealing the concentration of AI start-ups relative to population size. Berlin and Hamburg have the lowest ratios, indicating a strong presence of AI start-ups consistent with their status as major urban and tech centres. Bavaria and Baden-Württemberg also display relatively low numbers, reflecting their well-developed tech ecosystems. In contrast, several states, especially in East Germany, show much higher ratios, indicating a significantly lower density of AI start-ups per capita.

State | Inhabitants per AI Startup

Berlin | 13.365 Hamburg | 26.904 Bavaria | 56.928 Baden-Württemberg | 104.030 Hesse | 114.656 Saarland | 124.303 Bremen | 138.341 North Rhine-Westphalia | 197.722 Saxony | 240.557 Brandenburg | 286.852 Schleswig-Holstein | 329.521 Thuringia | 353.723 Rhineland-Palatinate | 379.483 Lower Saxony | 408.099 Saxony-Anhalt | 726.816

Funding:

Over the last 10 years, AI start-ups in Germany received a total funding of approximately 7,57 billion € (please note that this figure exclusively includes AI start-ups which are part of the AI Startup Landscape 2025). Compared to the last few years, it seems that the investment climate in Germany is improving significantly. In 2025 alone, > 2 billion € have already been invested until July.

Additionally, newly founded AI start-ups are benefiting from increased funding. While AI start-ups founded in 2022 and 2023 combined received a cumulative funding amount of only approximately 93 million €, AI start-ups founded in 2023 and 2024 received a cumulative funding of approximately 260 million €.

Approximately 42% (n = 394) of the AI start-ups listed in the AI Startup Landscape 2025 received a significant amount (> 1 million €) of funding (subject to publicly available information). For the AI start-ups with funding larger than 1 million €, the average amount of funding received is 19,2 million €, whereas the median is 5,1 million €. Notably, 124 AI start-ups received funding larger than 10 million € - an increase of over 50% compared to 2024.

Industry sector and enterprise functions:

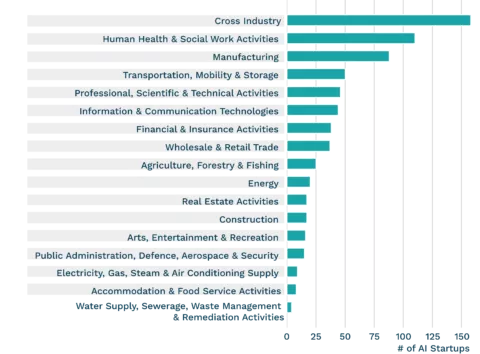

AI start-ups are highly concentrated in a few key sectors. Cross Industry (158) leads, reflecting AI’s broad and increasing applicability across domains. Human Health & Social Work Activities (110) follows, primarily driven by innovations in diagnostics, personalised medicine, and healthcare efficiency.

Manufacturing (88) shows strong adoption in automation, predictive maintenance, and quality control, while Transportation, Mobility & Storage (51) leverages AI for route optimisation, autonomous driving, and logistics. Information & Communication Technologies (44) and Professional, Scientific & Technical Activities (46) also demonstrate significant AI activity, alongside Financial & Insurance Activities (38).

The right-hand figure shows the distribution of AI start-ups among industries:

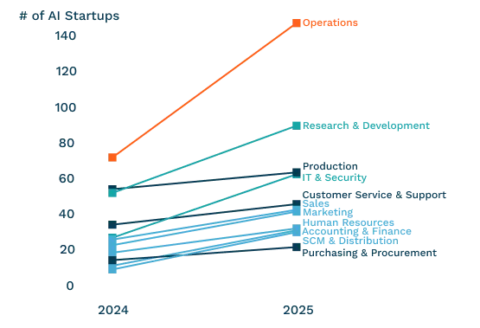

On the enterprise function front, German AI start-ups in 2025 are particularly active in the areas of Operations (142), Production (63), Research & Development (87), Customer Service & Support (45), IT & Security (61), and Sales (42). Compared to 2024, nearly all categories have seen notable growth. Operations jumped from 70 to 142 start-ups, IT & Security from 27 to 61, and Research & Development from 51 to 87.

This broad-based expansion signals a maturing AI start-up ecosystem that is no longer concentrated in a few niches but is spreading its capabilities across multiple core business functions. The pattern reflects both market demand for AI-driven efficiency, thereby indicating a more integrated role for AI in driving competitiveness across the German economy.

As in the last few years, the fact remains that almost all AI start-ups analysed are B2B start-ups. Indeed, more than 90% of the German AI start-ups focus on corporate solutions. In turn, only a very small number of AI start-ups operate exclusively in the B2C or B2G sectors - potentially indicating that these markets are dominated either by non-German players or by large corporations, or that AI adoption in these areas lags significantly behind the B2B sector.

Technology Type and AI Capabilities:

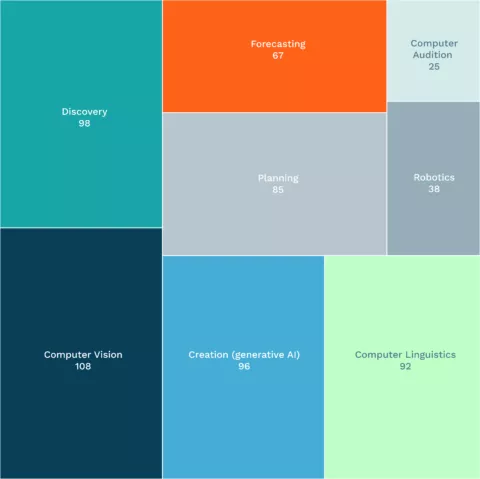

Regarding the technology type, German AI start-ups are predominantly active in developing Platforms (271), followed by Applications (267), Infrastructure (38), and Frameworks (25). As such, for the first time, platform developers outnumber pure application builders, underscoring a fundamental shift from point solutions towards scalable, reusable foundations for AI. This transition signals a maturing market in which start-ups are moving beyond building individual AI-driven products to creating scalable platforms that can serve as the foundation for multiple use cases across industries.When it comes to the underlying AI capabilities, the German AI Startup Landscape is characterised by a wide diversification of technological capabilities. Leading the field is computer vision (17,7%), closely followed by discovery (16,1%), creation (15,7%), and natural language processing (15,1%). Additional strengths include planning (14,1%) and forecasting (11,0%), while robotics (6,2%) and computer audition (4,1%) occupy more specialised niches.

Generative AI:

Generative AI is capable of generating new and unique content for various applications. These models are created by training a foundation model on large amounts of data and then fine-tuning it to improve its content generation capabilities. As such, a generative AI start-up focuses on leveraging generative AI technologies to develop innovative products, services, or solutions. These start-ups typically specialise in creating and deploying AI models, particularly those built upon foundation models, with the aim of generating unique and valuable content across various domains.

As part of this study, and in order to enable an objective and data-driven classification of each AI start-up, we developed an AI-based generative AI classification system. This classification system evaluated which of the 935 AI start-ups of this year’s landscape can be classified as working specifically on generative AI solutions. The results show that every third (n = 316) AI Startup is active in the field of generative AI. Compared to last year, this is a growth rate of approximately 130%. Such a sharp increase not only reflects the rapid technological advancements in generative AI, but also signals a strong market appetite for solutions leveraging these capabilities - from large language models and creative content generation to code automation and synthetic data production. The substantial share of start-ups focusing on generative AI illustrates how quickly this sub-field has evolved from a niche area into a core driver of innovation for the German industry.

Highlighted AI Startups in Germany

The AI start-up scene in Germany is continuing to grow, and new AI start-ups are founded on an almost daily basis. Thus, to gain deeper insights into the race at the top, we are pleased to announce the most promising AI start-ups in Germany 2025. This list was compiled based on a voting of the jury (i.e. Deutsche Telekom, NVIDIA, Hitachi, UnternehmerTUM, Cherry Ventures, Earlybird Capital, UVC Partners, Yttrium, High-Tech Founder Funds (HTGF), eCAPITAL, Burda Principal Investments, HV Capital, Bayern Kapital, BMH, and the AI.FUND)), where each contributor was allowed to nominate their picks. The final list was subsequently consolidated and ranked by the AI experts of the appliedAI Institute for Europe. The appliedAI Institute for Europe did not participate in the voting itself.

Based on the jury voting, the following start-ups were selected as being the most promising AI start-ups in Germany for 2025 (please note that the order presented is alphabetical and non-hierarchical):

Akhetonics

Apheris

ARX Robotics

Atira

Atmos Space Cargo

Black Forest AI

Deeploi

Deepset

Doinstruct

Langdock

n8n

Neura Robotics

Peec AI

Pruna

Q.ANT

Qualifyze

Quantum Systems

RobCo

Contributors

How you can use the AI Startup Landscape 2025

As a non-profit organisation, we believe that sharing high-quality knowledge is our obligation. Using this landscape as part of a presentation, talk, or project is allowed and encouraged as long as you always use the visual representation and reference us appropriately. Changes to the AI Startup Landscape 2025 have to be marked explicitly as your own changes. The content of this insight is published under CC-BY 4.0.

Contact Information

We would be more than happy to discuss the insights of the AI Startup Landscape with you. If you have any questions or comments, please feel free to contact us:

Disclaimer

The data used in the AI Startup Landscape 2025 was collected and analysed to the best of our knowledge and understanding at the time of writing. While we strive to ensure the accuracy and reliability of the information presented, it is possible that errors, omissions, or inaccuracies may exist. Therefore, we cannot guarantee the completeness, correctness, or timeliness of the information provided.

The content provided is intended for general informational purposes only and should not be considered professional or legal advice. Any reliance you place on the information is strictly at your own risk. We recommend verifying any critical information through additional sources or consulting with appropriate experts before making decisions or taking actions based on the information provided.

Subscribe to our newsletter

Would you like to find out more about the appliedAI Institute for Europe, our latest resources or events?

Then sign up for our monthly newsletter.